Understanding Wind Damage Claims: What Your Insurance Company Doesn’t Tell You

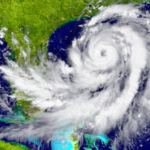

Wind storms can cause significant damage to your property, from structural damage to broken windows and fallen trees. While most homeowners’ insurance policies cover wind damage, the claims process can be more complicated than it appears. Insurance companies may not always disclose everything you need to know, which can result in lower settlements or denied claims. In this blog post, we’ll explore the hidden details of wind damage claims and how Side By Side Public Adjusters can help you navigate the process.v

We’re a Trusted and Professional Public Adjusters Company

Michelle Jones

The Fine Print of Wind Damage Coverage One of the biggest challenges in filing a wind damage claim is understanding the fine print of your insurance policy. Some policies have specific clauses or exclusions related to wind damage, which can limit your coverage. For example, if the wind damage leads to water infiltration, the insurer might classify it as flood damage, which could be excluded under your policy. Our public adjusters are experts at dissecting these policies to ensure that all aspects of the damage are covered.

The Importance of a Detailed Assessment Insurance companies may attempt to minimize their payout by downplaying the extent of the damage. A common tactic is to offer a settlement that covers only visible damage, ignoring potential structural issues or hidden problems like water damage within walls. At Side By Side Public Adjusters, we conduct a thorough assessment of your property, identifying all areas of damage—even those that aren’t immediately apparent. This comprehensive documentation is crucial in securing a fair settlement.

Negotiating a Fair Settlement Insurance companies are businesses, and their goal is to minimize payouts. This often means that the initial settlement offer is far less than what you’re actually entitled to. Without professional representation, policyholders may feel pressured to accept these offers. Our public adjusters are skilled negotiators who know the tactics used by insurance companies and how to counter them effectively. We fight to ensure you receive the maximum compensation for your wind damage.

Conclusion Filing a wind damage claim can be more complex than